General Ledger configurations

- Chris Segurado

- Mar 3, 2021

- 6 min read

General Information

Navigation path: General Ledger

The General ledger is leveraged to define and to manage a legal entity’s financial records. Short, the general ledger is a register of all debit and credit entries and these entries are classified using the main accounts that are listed in a chart of accounts. Entries are facilitated through automatic or manual journal entries.

In order to define the account structures, you need to take into consideration what the organization’s requirements are in terms of how to slice and dice its financial entries. For example, while small organization simply register debit and credit entries to main accounts with no further requirements, large multinational matrix organization may require adding another level/layer of granularity to slice and dice financial credit/debit entries by department, project, and/or cost center and thus are required to use financial dimension.

To incorporate more complex financial scenarios regarding financial dimensions, Dynamics 365 for Finance and Operations offers allocation rules. Allocation rules allow you to allocate, distribute financial amounts to one or more accounts or/and dimension combinations. There are two types of allocations: fixed and variable.

Journal names

Navigation path: General ledger/Journal setup/Journal names

A journal is a worksheet. Every manual posting entered in Dynamics 365 for Finance and Operations is entered through a journal. A journal is a type of worksheet where entries do not post immediately. You can review, change, and verify completed journals until they are ready for posting. Users can post transactions to the following accounts by using a general journal:

General ledger

Bank

Customer

Vendor

Projects

Fixed assets

Depending on the journal type assigned to the journal name, a journal is used in the system for different areas and purposes. For example, the daily journal type is used to create daily transactions in a general journal while the allocation journal type is used to create allocation transactions in an allocations journal. By nature, there is a differentiation between manually generated journals such as general journal entries and system generated journals such as allocation journals in D365FO. For now, we will focus on manually generated journals and the general journal.

For each journal name, a user can set up journal controls. Journal controls allow a user to specify what accounts and financial dimensions can be posted in a specific journal. There are no journal controls setup for the general journal in the CONTOSO environment. That means, there are no restrictions on what accounts and financial dimensions can be specified.

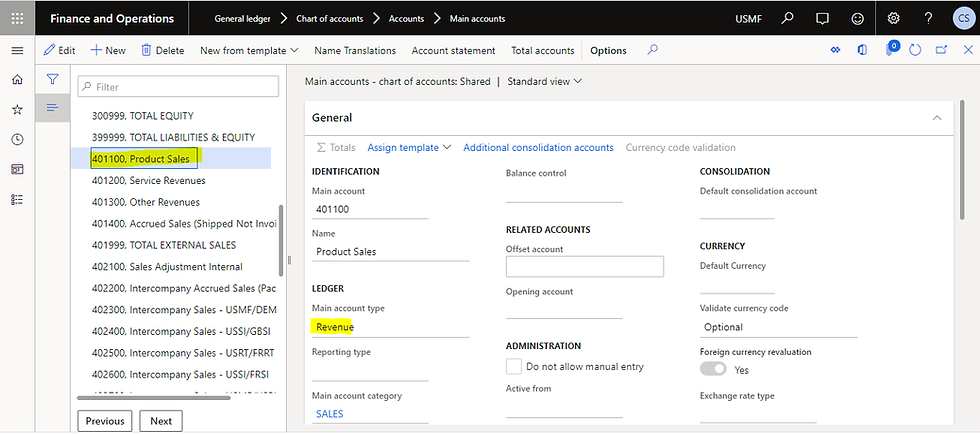

Main account types and main accounts

Navigation path: General Ledger/Chart of Accounts/Account structures/Main Accounts

Each main account is assigned an account number as a unique identifier. Usually the number sequence for main accounts follows logical numbering such as main accounts starting with 1 for asset main accounts, 2 for liability main accounts, 3 for equity main accounts, 4 for revenue main accounts, and 6 for expense main accounts, etc. That said, each main account created requires a main account type. The assigned main account type determines how a main account is leveraged in the chart of accounts and used in the system. See the different main account types below.

Balance sheet, Asset, Liability, and Equity – Such main accounts are leveraged as transaction accounts to record financial amounts that a legal entity owns or owes.

Profit and loss, Revenue, and Expense – Such main accounts are leveraged as posting accounts to record revenue and expenses. At year-end, the sum of all operating and active profit and loss/revenue and expense accounts determined the year-end results.

Total – Such main accounts are used to add up account intervals.

Reporting – Such main accounts are used simply for financial statement reporting.

Lastly, main account categories can be assigned to better classify a general ledger account. The purpose of assigning main account categories to main accounts is grouping or selection of ledger accounts that can be leveraged for reporting filters.

Chart of Accounts

Navigation path: General ledger/Chart of Accounts/Accounts/Chart of Accounts

The Chart of Accounts (COA) is the structured list of an organization’s general ledger accounts. The COA is specifying valid main accounts and structures to be used. For now, we will focus on the “Shared” Chart of accounts.

Financial dimensions

Navigation path: General ledger/Chart of Accounts/Dimensions/Financial dimensions

As shortly indicated above, financial dimensions are used as account segments for charts of accounts. There are two types of financial dimensions: Custom dimensions and entity-backed dimensions. Custom dimensions are shared across legal entities, and the values are entered manually and maintained by users. After you've created the custom financial dimensions, use the Financial dimension values button on the Actionpane to create and assign additional properties to each custom financial dimension manually by clicking +New. For entity-backed dimensions, the values are defined somewhere else in the system, such as in Customers or Stores entities. Some entity-backed dimensions are shared across legal entities, whereas other entity-backed dimensions are company-specific/legal entity specific. For now, we focus on the entity-backed dimension “Department”.

As department is an entity-backed dimension, we are not simply able to add the dimension value through the dimension values form below. As you can see below, the +New button is greyed out.

To add a new department value, we will need to add a new department first as operating unit under Human Resources/Departments/Departments.

Dynamics 365 for Finance and Operations now automatically added the newly created department as a new financial department value.

A user can set default financial dimension per item, vendor, customer, store, main account or journal – depending on business scenario. Taking the financial dimension defaults for items as an example: When using an item that has a default financial dimension specified, the default financial dimension value will be automatically populated when creating a new purchase order for this item.

See below, an example for financial dimension default for main accounts:

Configure account structures and advanced rules

Navigation path: General ledger/Chart of Accounts/Structures/Configure account structures

The account structures are used to define the valid combinations, which together with the main accounts, form a chart of accounts. The account structures allow you to define the sequence for entry of main account and financial dimensions. In this course, we focus on the “Retail Balance sheet – United States” and the “Retail Profit & Loss – United States” account structures.

The “Retail B/S – US” account structure below shows all allowed main account sequences and its allowed financial dimension values for Business unit and Department. In the below example, all main accounts allow a blank value (“”=blank) or all values (*=all) besides the 130000 main account. The 130000 main account does require a financial dimension entry for department and business unit – however, there is no further restriction enabled on what specific values are allowed such as only the finance department financial dimension value is allowed in the department field.

Advanced rule structure

Navigation path: General ledger/Chart of Accounts/Structures/Advanced Rule Structures

An advanced rule structure includes one or more financial dimensions that contain information that your organization wants to track, but that are not part of the account structure itself. An advanced rule needs to be associated with a specific account structure to be active. For example, an organization wants to track license plates for the vehicles that it owns as part of the vehicle maintenance main account. Currently, only one department uses those vehicles. To facilitate this scenario, a user can set up an advanced rule structure to track the license plate information for only that department.

Ledger

Navigation path: General Ledger/Ledger setup/Ledger

Each legal entity has one ledger, and each ledger can be linked to one chart of accounts. The chart of account and the account structures can be shared by configuring the Ledger page in each legal entity to use the same chart of accounts as well as account structures. Besides tying your configured account structures to the ledger, it is important to specify the accounting and reporting currency as well as the fiscal calendar.

Dynamics 365 for Finance and Operations differentiates between accounting and reporting currencies. The accounting currency is set up per legal entity and specifies which currency the legal entity uses for amount calculation and its transactions. The reporting currency is the currency used for operational reporting. In each entity ledger setup, an exchange rate for the reporting currency needs to be added if accounting and reporting currency differ.

Fiscal calendars provide a framework to track an organizations financial activity and is required for each legal entity’s ledger. A fiscal calendar contains 1 to many fiscal years with multiple periods each. While some organizations follow the calendar year for their financial activity, other may start throughout the year. When creating a fiscal calendar, a closing period is recommended to separate general ledger transactions that are generated when a fiscal year is closed. That said, if a fiscal year is divided into 12 fiscal periods (months), the closing period should be the 13th period.

Each period (at the ledger level) can be:

Closed completely (not recommended)

On Hold to block transaction posting

Set to enable selected users to continue an update of one or more modules (often used for month end close)

.png)

Comments